Mobile business continuity and compliance

Since the 2021 pandemic, distancing trading and banking operation is no longer a contingency plan: it is the new normal. Customers and employees rely on mobile transactions to manage instantly their assets.

This poses new challenges, related to business continuity, compliance, and security, when employees are now migrating to mobile android and iOS devices for their daily work tasks instead of only relying on fixed lines and PC.

A typical business continuity issue may appear when replacing fixed line by mobile at the branch location, and operator or Wifi coverage is not good enough.

Compliance issues may lead to huge fines, such as the hundreds of millions dollars ones several great financial institution have had to pay for not monitoring their employee use of mobile chat or other apps while doing business with their customers.

How can Samoby help financial institutions?

Samoby can provide financial institutions with a solution to monitor and troubleshoot network issues with mobile at the branch. For example we helped a leading spanish bank to troubleshoot VoLTE and VoWifi while substituting fixed line with Samsung smartphones at their branches.

We helped another financial institution selectively prevent their employees from using non compliant channels to communicate with their counterparties, such as whatsapp voice or video, while not blocking them from texting using the same whatsapp app.

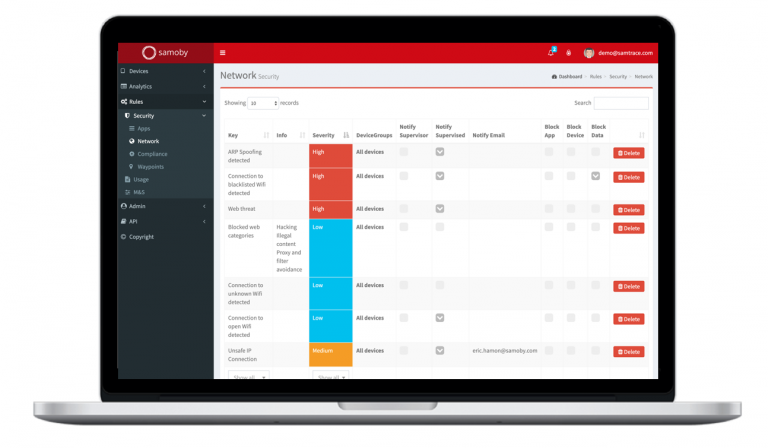

We can also provide forensinc information about what the users have been doing with their devices, the network they connected to, the app they used, and eventually apply compliance rules, or block non compliant or hazardous behaviours, of the users or coming from outside threats, such as network attacks, (MITM), mobile phishing, OS vulnerabilities or malicious or suspicious app installation.

Samoby acts silently, with no impact on device performance.